The Canadian mining sector is buzzing with exciting ESG innovations, driven by a skyrocketing demand for essential minerals and heightened regulatory scrutiny. Companies are now partnering with Indigenous communities, tapping into traditional knowledge to enhance sustainability. Investors are intensely focused on robust ESG strategies, enthusiastic to fund eco-friendly practices. With stricter regulations on the horizon, maintaining transparency and biodiversity commitments is vital. Stay tuned, as there’s a lot more to unpack in the world of sustainable mining!

Quick Overview

- Canadian mining companies are prioritizing ESG practices to attract investment and meet rising demand for critical minerals by 2050.

- Indigenous partnerships are reshaping mining practices by integrating Traditional Knowledge and fostering community involvement through Impact Benefit Agreements.

- Increased investor expectations are driving mining firms to enhance ESG disclosures and demonstrate resilience against climate risks for capital access.

- Innovations in eco-friendly extraction methods are being developed to minimize environmental impact and align with investor demands for sustainability.

- The regulatory landscape is tightening, necessitating stronger ESG commitments, transparency, and adherence to biodiversity and climate adaptation strategies in mining operations.

Current Trends in ESG Practices in Canadian Mining

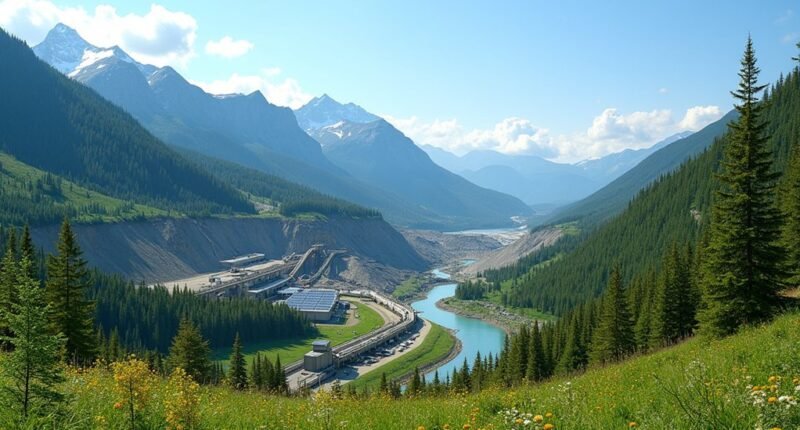

As the Canadian mining sector embraces the future, it finds itself at a crossroads where environmental, social, and governance (ESG) practices are not merely optional add-ons but essential components of its operational playbook.

With Canada stepping up as a global supplier of critical minerals, the demand for metals like lithium is skyrocketing—up to 17 times by 2050! This growing demand for critical minerals is driving investments and innovations in sustainable mining practices. The recent ESG standards overhaul aims to eliminate duplication and reduce reporting fatigue, fostering a more coherent framework for the industry.

The sector is innovating, focusing on eco-friendly extraction to meet investor demands. New standards are emerging, streamlining ESG practices and reducing reporting fatigue. The three pillars of ESG provide a comprehensive framework for evaluating mining companies’ long-term sustainability and ethical impact.

Ultimately, mining companies recognize that a solid ESG strategy isn’t just good ethics; it’s good business in a changing world.

Indigenous Partnerships in Sustainable Mining

How can Indigenous partnerships transform the mining landscape in Canada?

These collaborations, rooted in Traditional Knowledge, are reshaping mining practices from planning to reclamation. Elders guide projects like the Ekati mine, ensuring cultural significance, such as the caribou’s role, is respected. The area around Lac de Gras lake is considered traditional lands of Aboriginal people, emphasizing the importance of respecting and integrating their heritage in mining operations. Moreover, these partnerships can lead to a shift in narrative that aligns mineral development with Indigenous rights.

Collaborations grounded in Traditional Knowledge are revolutionizing mining practices, honoring cultural significance and environmental stewardship.

Over 500 Impact Benefit Agreements foster co-governance, offering Indigenous communities a voice beyond mere financial compensation.

Indigenous peoples’ ecological practices for sustainable land management offer valuable insights for mining restoration and environmental protection. With funding for Indigenous-led projects and the mining industry as a leading employer, opportunities abound.

It’s a win-win: sustainable revenue streams for communities and responsible resource management for miners, proving that together, they can strike gold—figuratively and literally!

Investor Expectations Driving ESG Strategies in Mining

In the evolving landscape of mining, the spotlight has shifted from Indigenous partnerships to the expectations of investors who are wielding significant influence over Environmental, Social, and Governance (ESG) strategies.

Today, capital access hinges on robust ESG disclosures, with lenders demanding proof of resilience against climate volatility. As nature risks loom large—potentially slicing earnings by 25%—finance sources favor projects that meet high ESG standards. Furthermore, Canada’s renewable energy advantage enhances the competitiveness of mining operations, making them more attractive to investors focused on sustainability. Additionally, critical minerals are essential for clean technologies, further driving investor interest in sustainable mining practices.

With regulations tightening and shareholder accountability on the rise, mining companies must embrace climate adaptation and biodiversity commitments.

In this competitive arena, those who align with investor expectations will secure the desired capital and community trust.